Zeroing in on Your Company’s Profit Zone challenges a CEO to engage every single person in his/her company to understand how each job impacts a company’s bottom line.

Zeroing in on Your Company’s Profit Zone challenges a CEO to engage every single person in his/her company to understand how each job impacts a company’s bottom line.

This unique approach gives a Growth Curve Specialist another opportunity to differentiate themselves as they deliver content designed to allow a CEO to decide how much financial information or how little financial information he/she want to share with their employees.

In Zeroing in on Your Company’s Profit Zone, financial literacy is the goal and improving profitability is the outcome.

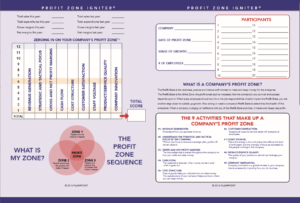

There are 9 activities that impact a company’s Profit Zone. A company’s Profit Zone is the relentless, precise and intense mindset to make and keep money for the enterprise. If a company is zeroing in on their Profit Zone, they are assuring that every employee knows how his or her job responsibilities impact a company’s ability to make money.

Statistically, less than 10% of a company’s staff understands how the enterprise actually makes and keeps money. Most employees are shocked at how little a company actually makes.

A company’s very survival depends upon understanding and zeroing in on this strike zone, the profit sweet spot.

In this day and a half workshop, a Growth Curve Specialist engages a CEO and his/her management team in a concensus-driven exercise to uncover how well the company is doing in zeroing in on their profit zone.

A twenty-seven question assessment drills down into detail on how well the company perceives it’s effectiveness in these 9 profit-building areas of focus:

- Revenue generation

- Strategic and tactical focus

- Gross and net profit margins

- Cash flow

- Cost structure

- Customer satisfaction

- Staff voltage

- Product/service quality

- Company innovation

Discussion and dialogue driven by how each person answers the questions, lead to critical initiatives that identify a company’s strengths and highlights areas that need attention.

Throughout this workshop, critical financial concepts are discussed. Concepts that include:

- The purpose behind running a business – improving profits and reducing costs

- How the company defines profit, identifies profit and creates profit

- Financial analysis tools such as the Profit & Loss statement, budgets and cash flow management

- How employees time impacts profit

- How efficiencies impact profit

- How performance impacts profit

A CEO is in complete control over how much financial information they share with employees. By starting with small, intentional steps to simply educate the management team on how the company makes and keeps money, the CEO is starting to create a culture of financial literacy.

The ultimate goal of Zeroing in on Your Company’s Profit Zone is to create confidence and supply the tools the management team needs to begin educating their staff on how jobs throughout the company impact the bottom line.

The ability of the Growth Curve Specialist to empower the management team to look at the 9 activities of their company’s profit zone will create a benchmark of profitability. Returning 6 months later to re-engage the management team on the 27-question assessment will solidify the progress made in an objective, visual manner that can be shared by the entire company.

As the second, revenue-generating program a Growth Curve Specialist has to offer, this program transcends a company’s stage of growth. This program will be effective with any size company, small, with one or two employees all the way up to corporations with thousands of employees who are looking to help their managers find ways to motivate employees to help improve profits and reduce costs.